Friday, 10 a.m. in Washington. The Supreme Court of the United States reconvenes for the first time in weeks. On Wall Street there is tense silence. Not because a new stimulus package is being passed. But because nine justices could decide whether a president may use emergency powers to steer global trade flows. In Learning Resources v. Trump, the central question is: May the White House rely on a 1977 law, the International Emergency Economic Powers Act, to impose tariffs in response to economic emergencies? Donald Trump has done exactly that over the past 14 months. Invoking economic “emergencies,” so called Liberation Day tariffs were imposed, accompanied by regular threats against individual countries. The measure hit supply chains, industry, trade - and everyday prices.

What the justices decide will have immediate consequences. Analysts expect a spontaneous move in the S&P 500 - depending on the ruling between minus one and plus two percent. That alone shows how nervous the markets are. One scenario would be a victory for Trump: the tariffs remain in place. Another would be a clear defeat: the regulations are struck down. A middle path is also possible, in which the tariffs are declared unlawful but refunds are not ordered - or the question of repayments is sent back to lower courts. The dimension is enormous. Since the beginning of 2025, the US government has collected more than 260 billion dollars in tariffs. Estimates suggest that around 55 percent of that stems from precisely the measures now under judicial review. In total, roughly 130 billion dollars are at stake. Should the Court decide that these “blanket tariffs” were unlawful and must be refunded retroactively, companies face weeks of uncertainty. Claims for repayment, balance sheet corrections, new pricing calculations - this would not be an administrative detail, but an intervention in ongoing business models.

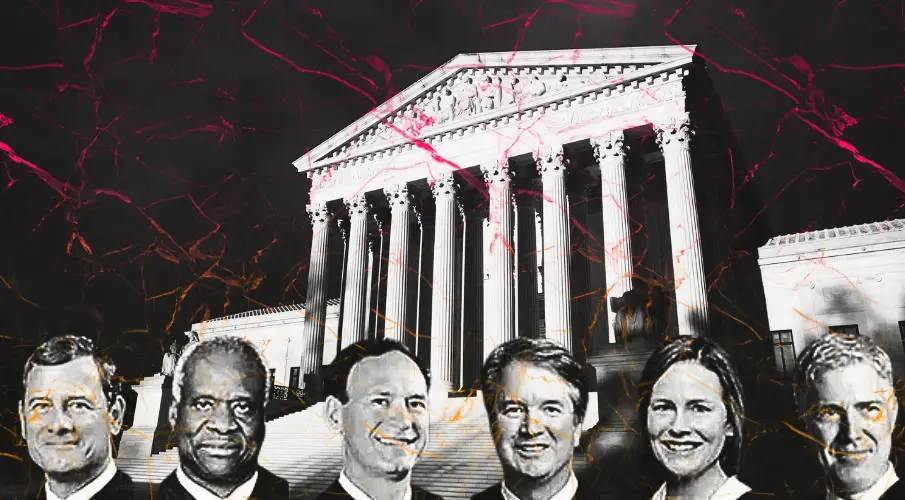

At the same time, it is clear: even a ruling against the president would likely not be the final word. Trump has repeatedly announced that he will “find a solution” if the Court does not support his line. It would then “not be as nice as now,” he recently said. His advisers have likewise signaled that other legal bases would be examined. The political environment does not make the situation easier. The midterm elections are approaching, and many of his recent steps aimed at softening certain tariffs. An abrupt shift in course could trigger new tensions - domestically and economically. During oral arguments in November, the justices appeared reserved but critical. Chief Justice John Roberts summed it up: regardless of a president’s foreign policy motives, the power to levy taxes remains a core authority of Congress. And that authority must not be lightly circumvented. The possibility of mass refunds was also raised. Such a development could become “chaotic,” it was said from the bench.

At the same time, another case is on the docket that concerns the independence of state institutions: the government’s attempt to dismiss Federal Reserve Governor Lisa Cook. Here as well, doubts about the White House’s argument were audible. Together, these cases paint a picture of a power struggle between the executive and institutions that goes far beyond individual personnel matters or tariff rates. Whether the ruling will be issued on Friday remains open. The Court announces its sitting days in advance, not the content of its decisions. Further dates have already been announced, including the day of the State of the Union address. The delay can mean many things: a majority drafting a complex opinion; disagreement over refunds; simply the care such an intervention in the economic order requires.

While the Supreme Court deliberates on the legality of the tariffs, the latest trade figures reveal a sober reality. The US trade deficit declined slightly last year to around 901 billion dollars. The year before it stood at 904 billion. Three billion less - in an economy of this size, that is hardly more than a statistical shift.

Trump reshuffled global trade with double digit punitive tariffs on imports from most parts of the world. The move was meant to bring industry back, fill state coffers, and reduce dependencies. In fact, exports rose by six percent in 2025. At the same time, imports also increased by nearly five percent. The gap between what the United States sells and what it buys thus remained at a historically high level.

The pattern at the beginning of the year is striking. Between January and March, the deficit initially surged. Companies attempted to bring goods into the country before additional tariffs took effect. Afterward, the gap declined again and stabilized. This shows how much political announcements themselves have become a market factor. Anyone who announces tariffs triggers advance purchasing effects. Supply chains react faster than any press conference. Tariffs are not an abstract instrument. They are paid by US importers. Many pass these costs on to their customers. The expectation of many economists was therefore clear: rising prices, noticeable inflation. Yet price pressure was lower than forecast. That is also because companies adjusted margins and restructured supply chains. The inflation surge did not materialize, but the structural questions remain.

Trump argues that the tariffs protect American industries and bring manufacturing back to the country. He also says money flows into the state treasury. It is correct that since early 2025 more than 260 billion dollars in tariffs have been collected, a significant portion from the measures now before the Court. It would be wrong, however, to assume that a trade deficit disappears solely through punitive duties. Trade flows shift, they do not vanish. When exports and imports grow simultaneously, the underlying structure remains untouched. A deficit of this magnitude does not arise overnight - and it does not disappear through unilateral tariff increases.

This intensifies the political dilemma. Should the Supreme Court limit the legal basis for the tariffs, the central instrument of the administration comes under pressure. If they remain in place, the question of their economic effectiveness persists. Three billion dollars less deficit is not proof of a fundamental trend reversal. In the end, not only the Court decides, but the reality of the numbers. 901 billion dollars speak a clear language: the American economy remains dependent on imports, while its exports are growing, but not to the extent required to close the imbalance. Tariffs may demonstrate political strength. The trade balance responds to other forces.

Research Shows: The 862,000 Lie - How Trump Faked His Job Miracle and Why AfD Voters Should Be Warned

(Our investigation from February 11, 2026)

The numbers are on the table. The Bureau of Labor Statistics has counted again. What Donald Trump sold as an economic success turns out to be a statistical illusion. 862,000 fewer jobs than originally reported. Not seasonally adjusted. Seasonally adjusted, the figure is even 898,000. This is not a footnote detail. It is the difference between propaganda and reality.

1000 Dollars Less Per Family - Trump’s Tariff Policy Is Eating Through Grocery Carts and Gas Pumps

Our investigation from February 10, 2026

1,000 dollars. That is how much Trump’s tariffs cost the average American household last year. For 2026, economists are already projecting around 1,300 dollars - assuming the existing duties remain in place. This is not a marginal figure but, according to calculations, the largest tax increase as a share of gross domestic product since 1993. At the same time, the White House marketed the tariffs as a machine generating billions and trillions. In reality, the government collected about 264 billion dollars in tariff revenue in 2025 - far from the promised sums.

What is certain: whatever is decided, the markets will react. In the short term perhaps sharply, in the long term possibly more soberly. One analyst put it this way: one should expect an initial overreaction, followed by quick sobering. And in the end, according to many observers, tariffs - in whatever form - could remain part of the political landscape. The justices do not work to the rhythm of the stock market and not to the calendar of politics. They decide in their own cadence. For companies, investors, and consumers, however, much depends on whether a president may broadly interpret economic emergencies to conduct trade policy unilaterally. On Friday it may become clear where the boundary lies.

Updates – Kaizen News Brief

All current curated daily updates can be found in the Kaizen News Brief.

To the Kaizen News Brief In English

1,000 dollars more per family, a trade deficit of 901 billion dollars, in November alone a deficit of 56.8 billion - and 862,000 jobs that after official revision never existed. That is the record of a president who promised to economically liberate America. Trump tore open global trade with brutal tariffs, established the highest tariff level in generations, and claimed he would end the trade imbalance. In reality, the deficit remained nearly untouched, fluctuated in extreme swings, and exploded again in the fall.

Exports declined, imports rose, companies reacted with panic imports and tactical shifts. No trace of structural strengthening. At the same time, households pay higher prices for groceries, consumer goods, and energy, while the supposed job miracle collapses and turns out to be a statistical exaggeration. If after radical interventions neither the deficit disappears nor growth holds, but uncertainty, price pressure, and legal chaos remain, then this is not a controversial experiment, but an economic failure. Trump did not deliver - he promised, polarized, and in the end left numbers that contradict his own narrative.