More than six months after the start of Donald Trump’s second term, the American economy is showing a state that has little in common with the grandiose promises of a new “golden age.” The latest data paint a picture that is all too familiar to any economist: sluggish growth, rising prices, and a labor market that is losing its momentum. For the international economy, this means more than just an American problem - it is a global experiment with an uncertain outcome.

The warning signs are mounting. In July, only 73,000 new jobs were created in the US, after a meager 14,000 in June and 19,000 in May. Taken together, net employment over the past three months is 258,000 jobs lower than originally reported. The much-cited industrial revival failed to materialize - on the contrary, since Trump’s major tariff pivot in April, 37,000 manufacturing jobs have been lost. At the same time, inflation is accelerating - the core rate of personal consumption expenditures rose to 2.6 percent in June, from 2.2 percent in April. Particularly affected are import-intensive goods: household appliances, furniture, toys.

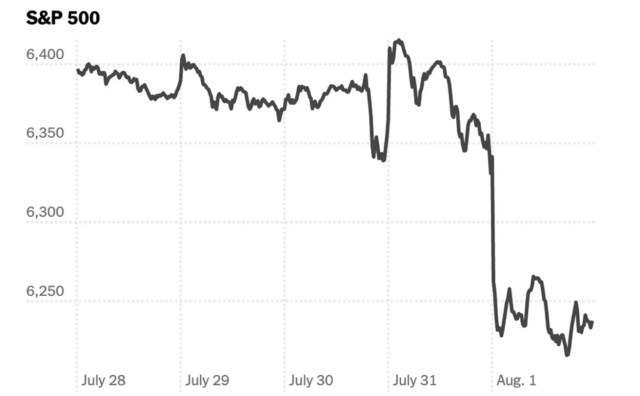

The gross domestic product also shows a clear dip. In the first half of the year, the US economy grew at an annualized rate of less than 1.3 percent, after 2.8 percent in the previous year. Guy Berger, Senior Fellow at the Burning Glass Institute, summed it up dryly: “The economy is limping along. We are hardly losing jobs, but we are also creating almost none. It looks like a classic ‘meh’ economy.” Trump himself reacted to the data with political staging instead of analysis. On Truth Social, he declared the US economy “BOOMING” and promptly fired the head of the statistics agency that publishes the monthly labor market figures - a symbolic move that further unsettled the markets. For the president, the rule is: he claims every success, but the responsibility for possible setbacks is to lie with others.

Behind the numbers lies an economic gamble of historic proportions. Trump’s agenda of blanket import tariffs, massive tax cuts, targeted spending reductions, and regulatory deregulation aims for short-term national advantages - while accepting long-term uncertainty. The tariffs, effectively hidden consumption taxes, will only unfold their full effect with a delay. Republican strategists like Alex Conant are already warning: “The inflation effects of the tariffs will only hit in 2026 - unfortunately, that’s an election year.” The latest market turmoil shows that Trump’s economic strategy is anything but predictable. While the president openly attacks the Federal Reserve and forces interest rate cuts, the risk grows that cheap money will further fuel inflation. Two Fed governors - Christopher Waller and Michelle Bowman - voted for the cut, but out of concern for the cooling labor market, not because of Trump’s populist growth fantasy. The president ignores such nuances, but the markets do not.

Global feedback - Europe does not remain untouched

The transatlantic dimension of Trump’s economic policy should not be underestimated. At first glance, Europe may seem like only a spectator to an American experiment, but the economic feedback effects are immediately tangible. Even now, global trade flows are shifting because Trump’s blanket tariffs distort the market’s price mechanisms. European exporters, from the automotive industry to highly specialized machinery manufacturers, benefit in the short term, provided they remain exempt from new special rules. But these advantages stand on fragile ground, because the volatility of US trade policy complicates any strategic planning and makes investment decisions riskier.

Trump’s decisions also act on the financial markets like a permanent electric shock. His relentless demands for interest rate cuts put pressure on the dollar and provoke capital movements that appreciate the euro - a scenario that doubly burdens the European export sector. At the same time, global commodity prices are rising because the US increasingly presents itself as a self-sufficient supplier while fragmenting international spot markets. For Europe, which depends on stable import prices in many key industries, this means growing uncertainty in energy and raw materials.

Finally, Trump’s economic experiment unleashes a psychological and political spillover. The nervousness of American markets is transmitted almost synchronously to European stock exchanges, while political voices in the EU grow louder calling for their own protectionist counterbalance. Should the US economy slip into a genuine downturn next year, the eurozone will inevitably feel the impact - particularly the export-oriented economies of Germany, the Netherlands, and Scandinavia. In the end, it becomes clear: what is staged as a national triumph is in reality a global risk maneuver whose aftershocks extend far beyond the Atlantic.

Investigative journalism requires courage, conviction – and your support.

Er wird schon sein Geld, Immobilien, Bitcoin scheffeln.

Was anderes interessiert ihn nicht.

Weder seine Kinder noch Enkelkinder.

Hauptsache er. Was nach ihm kommt, juckt ihn nicht.

Das Schlimme ist nur, dass es sich auf die ganze Welt auswirkt.

Auch nicht hilfreich, dass Europa artig bei seinem Spiel mitmacht und ihn lobt.

Wie andere Länder auch.

Und wer ihm geldlich nichts zu bitten hat, schlägt ihn eben für den Friedensnobelpreis vor (wie gerade Kambodscha).

Nur egal wie man ihm die Füße küsst.

Echte Virteile darf man sich als Handelspartner nicht erhoffen.

Wer das noch bicht verstanden hat, ist absolut blind.

Es muss ein Umdenken in Europa stattfinden – Der Abgang von Stoltenberg ist aktuell nicht ersetzbar, er hatte Trump recht gut im Griff.

Sehr guter Bericht und Europa ist viel zu brav. Leider sind viele hoch bezahlte Medien ruhig und angepasst, und die, die sehr gut aufklären und informieren gehen meist leer aus. Finde den Fehler.

Ich danke Dir – liebe Grüsse